Deficit, Debt and Damocles: the abysmal silence of the candidates (1/2)

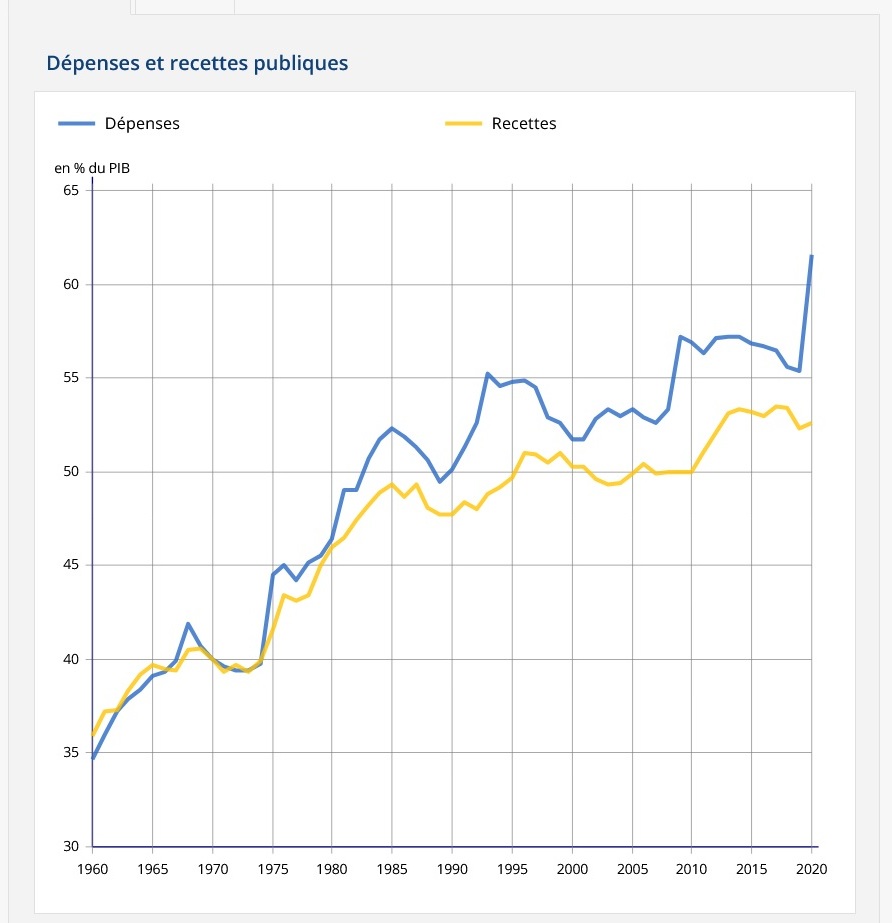

It has been years since we have no longer invested in the debts of the French state. So explained a banker during an interview on deficit, this summer. All of a sudden, despite the summer heat, the atmosphere coldened. Indeed, when a large financial institution clearly expresses to you that it does not believe that you will ever be able repay your debt, that raises questions about our collective will to negate – or even to slow down – the structural debt of our society. Simply put, the fact that we are travelling in the first class, essentially since 1981 but with a second class ticket provoke suspicion among certain financiers. Some figures: at the end of 2020, the French public administrations debts stood at 2,650 billion euros that is to say 115.7% of the GDP (under the Masstricht treaty). As the French state controls 64% of the Gross Domestic Product, 2290 billion euros, this signifies that its indebtedness is equal to 1.8 times of its revenues. In conclusion, the State, in other words, we ourselves, are not indebted to a little more than 100% of the produced wealth but rather more around twice its revenues.

To that, we must include the off-balance sheet commitment costs (pension of civil servants and special schemes like the SNCF, the RATP and the pension to sailors, the management of industrial (nuclear…) or ‘natural’ (floods, forest fires…) catastrophes. A budget that amounted to 4,100 billion euros in 2016 according to the AFP.

Yes, of course, you will tell me that the debt is a problem but the French state continues to borrow at very low rates after having even reached negative rates. If this is true that Germany can get indebted at even cheaper prices, we, French are in a continuous fiscal deficit essentially since 1981. Even during the phases of economic and financial growth, as between 2011 and 2019, we could not slow down our pace of indebtedness. The challenge is no longer that we are heading towards the abyss but that we are already there, after more than 40 years of electoral lies. We no longer have since a long time the means for our way of life.

Certain French economists think that a public debt does not have to be paid off. However, it’s quite the opposite! As I had already told in a preceding article: a debt is always repaid. Always. Except when the borrower cannot pay, it is the creditor who does (note that otherwise, this axiom is applicable not only in the financial domain but also in the others). However, who are the creditors of the French debt? We certainly find some foreign investors (the half of the CAC 40 (a European stock market index) are held outside France) but the holders of life insurance, of Livret A (a French financial product / savings account provision), and other savings account also. How do you also have a life insurance and a savings account? Yes. Indeed, more than 2000 billion euros are stocked up in bank computers: Mr. Macron would like this jackpot to go further to companies and not stay on ‘safe’ books/accounts but less productive. Presidential objective: that all that generates a little more tax revenue.

Now, no presidential candidate – thirteen declared and two potential (including the current president) – if they all happen to get the signatures of five hundred mayors – clearly and concretely comment on the issue. However, that is simple: paying off a debt means working more to earn less. The surplus generated by a possible increase in the activity, even by an increase in productivity [1]Productivity: increase in production for a same level of investment, would not only afford to stop from spending more than what we do not earn but above all begin to pay the debt off.

There is no shortage of tools to reimburse what we owe: increase taxes (but we are already OECD champions in terms of taxes), reduce spending (we have a lot of leeway here to make our public money more efficient), sell an additional part of our heritage, including the CAC 40 (but this will not solve the structural problems of our public management) or even use inflation (but the latter is under the control of the European Central Bank, not under that of the French Executive). If not, there remains one last radical means: “to erase” the debt. This means, as mentioned above, making the creditors pay: that is to say, among others, French savers. In short, whatever way you take the problem, the circle has come full circle and painfully.

Translation: Vidhi Taparia, BdF.

Références